The Single Strategy To Use For Accounting Franchise

Table of ContentsSome Known Details About Accounting Franchise Accounting Franchise Can Be Fun For AnyoneThe Definitive Guide to Accounting FranchiseFascination About Accounting FranchiseSome Known Details About Accounting Franchise An Unbiased View of Accounting FranchiseRumored Buzz on Accounting Franchise

Every organization, including home service franchises, has tax obligation commitments. With accurate books, a franchise business can guarantee it pays the correct amount of tax not a penny more, not a cent less. In addition, a well-kept record can help in use tax advantages, reductions, and debts that a franchise may be eligible for.Banks, lenders, and investors frequently think about constant and precise bookkeeping as a sign of a business integrity and reliability. While it may feel like accounting includes in the tasks of a franchise, in the future, it saves both money and time. Visualize the initiative required to backtrack and recreate financial statements in the lack of routine bookkeeping.

All About Accounting Franchise

The heart of any type of business hinges on its monetary pulse. For a home solution franchise, amidst the obstacles of service top quality, client relationships, and operational efficiency, is simple to forget the foundational role of accounting. As outlined over, this 'back-offic job is a powerhouse of understandings, protections, and development strategies.

It furnishes a franchise business with the tools to thrive in today's affordable market and leads the way for a sustainable, lucrative future.

To possess and run a franchise, you will be called for to pay certain franchise fees. A franchise business, most of the times, is comprised of two different entities: a Franchisee and a Franchisor. A franchisor is a business that sells or rents its brand, company systems and/or techniques to one more person. In various other words, it is the parent firm for any provided franchise.

Accounting Franchise - Truths

A franchisee is an individual that has actually bought (or rented) the legal rights to a specific area from the franchisor. Each franchise business has different policies a Franchisee need to comply with. For the most part, a Franchisee is granted permission to utilize the name, logo, and general likeness of a company (Franchisor). If a company is also a Franchise, opportunities are, they are a well-established business with a huge client base and a strong organization design.

Leverage both conventional and digital marketing channels to produce a robust online visibility. In a lot of cases the parent firm will supply some aid when it pertains to marketing your franchise, but we extremely recommend creating a strategy to boost exposure. Hiring a neighborhood marketing or internet style company can assist you preserve your digital existence in the regional market.

Accounting Franchise Things To Know Before You Get This

For the many part, it has to adhere to specific why not look here guidelines and formulas stated by the Franchisor. Also though each franchise company runs in different ways, there are particular points that require to be videotaped in basically similarly for all franchise business companies. Embarking on a franchise journey is a significant undertaking that requires mindful factor to consider of different aspects.

By investing time and initiative into these considerations, you position yourself for a prospering franchise business venture. The franchise accountants at Volpe Consulting & Accounting would certainly enjoy to respond to any inquiries you might have. We have aided organizations in a variety of industries set themselves up for economic success with our budget-friendly franchise business bookkeeping solutions and franchise business pay-roll services.

8 Simple Techniques For Accounting Franchise

For franchise owners, navigating the complexities of bookkeeping can be an overwhelming difficulty. Professional accountancy services tailored specifically for franchises and small service owners in the United States can make all the difference in making sure Franchise accountancy goes beyond basic bookkeeping; it's about,, and maintaining compliance with and tax returns.

Franchise bookkeeping services aid deal with the specific established by. This ensures that franchise business keep while sticking to the standards established by the moms and dad business - Accounting Franchise. Effective management of franchise financial resources is an essential emphasis location for services. These professionals have know-how in taking care of intricate monetary aspects one-of-a-kind to franchises, such as profits sharing with franchisors and tracking nobilities owed based on sales efficiency.

These experts have the expertise to browse the specific intricacies associated to franchise taxes, ensuring precise and prompt tax conformity for franchise businesses. They manage various facets such as sales tax reporting, pay-roll tax obligation compliance, and earnings tax obligation prep work customized to meet the special demands of franchises. Furthermore, these specialists are adept at dealing with the details associated withthat commonly influence franchises running across different regions.

Some Known Details About Accounting Franchise

Franchise accountancy services are well-versed in dealing with any type of special considerations related to if a franchise runs outside its home nation. They make certain that all adhere to pertinent legislations and policies while also maximizing tax obligation benefits where suitable. Moreover, these experts concentrate on to optimize tax savings especially tailored for franchise business.

Expert bookkeeping for franchise business includes meticulous interest to detail, guaranteeing of revenue, costs, and other economic transactions for the firm. This degree of proficiency is crucial for giving accurate understandings into a business's financial wellness. Additionally, these understand the complexities click to read entailed in handling numerous places or units within a franchise system.

The 6-Second Trick For Accounting Franchise

These on-demand advising services allow franchises to benefit from the expertise of without having to hire them full time. It resembles having a group of seasoned experts available whenever needed, providing valuable insights right into financial matters unique to the franchise market. New franchise business get devoted from that focus on resolving the economic facets details to brand-new organization arrangements.

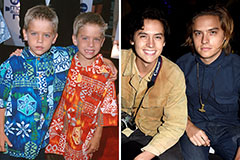

Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!